Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Descrição

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Federal Insurance Contributions Act - Wikipedia

Payroll tax in Texas: What employers need to know

How the Wage Base Limit Affects Your Social Security

Understanding FICA Taxes

What is FICA Tax? - The TurboTax Blog

:max_bytes(150000):strip_icc()/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is the Self-Employed Contributions Act (SECA) Tax?

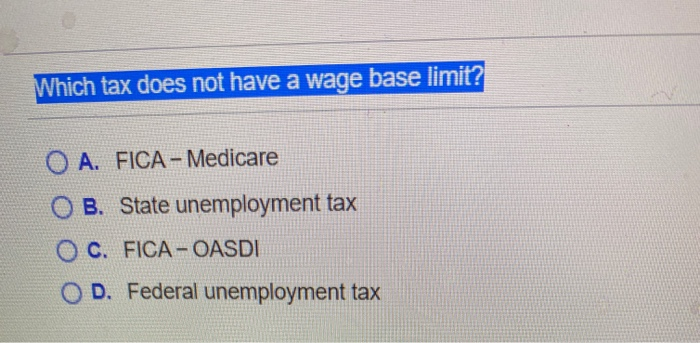

Solved Which tax does not have a wage base limit? O A. FICA

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

2023 Social Security Wage Cap Jumps to $160,200 for Payroll Taxes

What Is FICA, and How Much Is FICA Tax?

What are Employer Taxes and Employee Taxes?

Breaking Down the Taxable Wage Base Limit: Implications for Your

de

por adulto (o preço varia de acordo com o tamanho do grupo)