How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Descrição

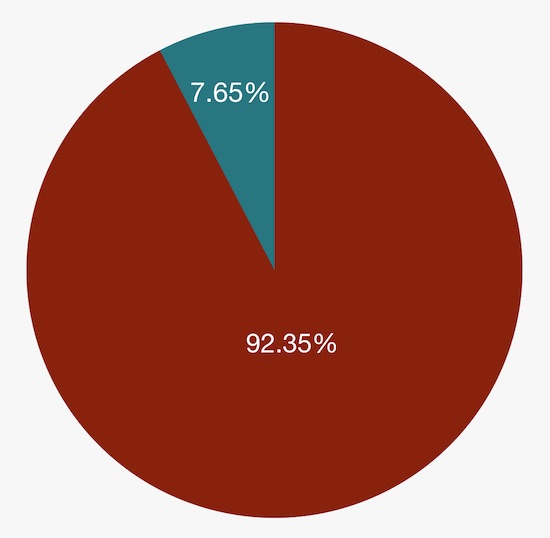

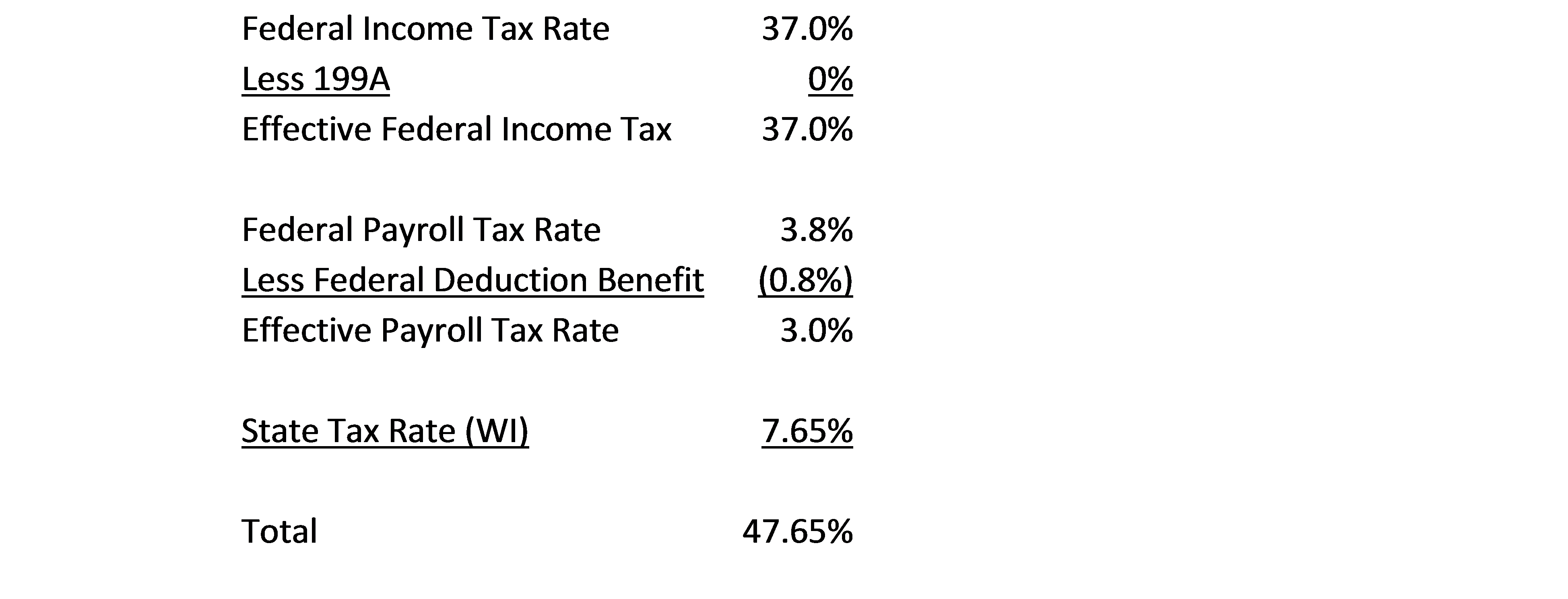

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

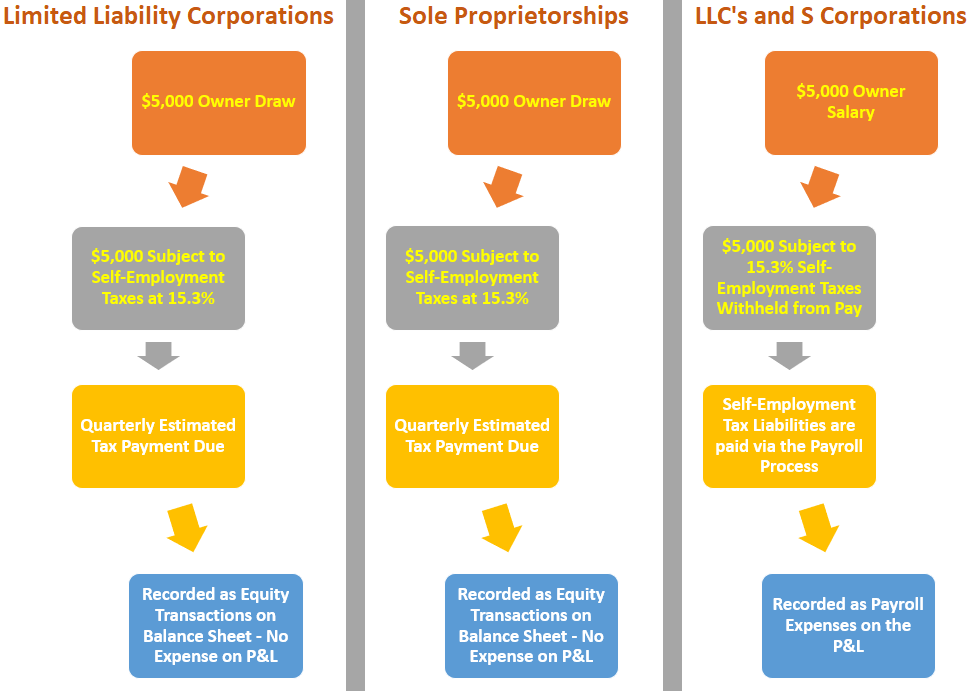

How an S Corporation Can Reduce Self-Employment Taxes

Why You Should Form an S Corporation (and When)

Self Employment Tax - FasterCapital

The Complete Guide to Self-Employment Taxes

Understand How Small Business Owners Pay Themselves & Track Self-Employment Tax Liabilities - Lend A Hand Accounting

Tax Foundation Needs to Fix Their Map - The S Corporation Association

What is Self-Employment Tax? (2022-23 Rates and Calculator)

How Much in Taxes Do You Really Pay on 1099 Income? - Taxhub

S Corporation Advantages and Disadvantages (2023 Update)

Filing S Corp Taxes 101 — How to File S Corp Taxes

How to Minimize and Avoid Your Self-Employment Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)