Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Descrição

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

The Value Added Tax in the United Kingdom

Estimating the repercussions from China's export value‐added tax rebate policy* - Gourdon - 2022 - The Scandinavian Journal of Economics - Wiley Online Library

Business Tax in the UK: Everything You Need to Know - NerdWallet UK

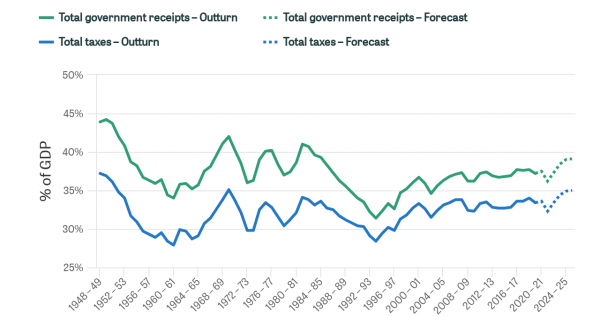

How have government revenues changed over time?

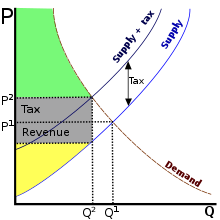

Sales Tax: Definition, How It Works, How To Calculate It

NewsWire - Government to increase the VAT percentage up to 18% with effect from January 01, 2024.

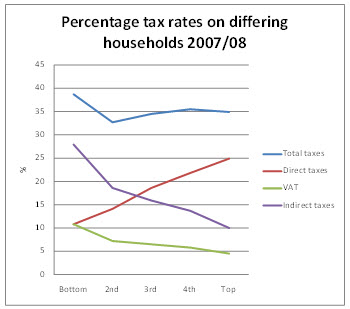

Why VAT is regressive

Indirect taxes

Shareholder Value Added

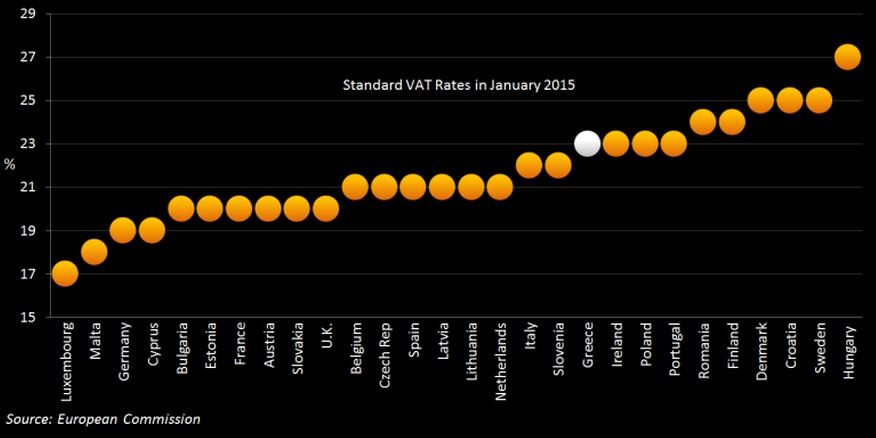

Why Greece's VAT increase is unlikely to work, Insights

Value-added tax - Wikipedia

What tax do you pay if you sell on ? – TaxScouts

A Comparative Analysis of the VAT System of Developed and Developing Economies (UK and Nigeria)

de

por adulto (o preço varia de acordo com o tamanho do grupo)